Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

645 |

| MoneyManMatt |

490 |

| Still Looking |

399 |

| samcruz |

398 |

| Jon Bon |

385 |

| Harley Diablo |

373 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| You&Me |

281 |

| Starscream66 |

264 |

| sharkman29 |

251 |

| George Spelvin |

248 |

|

Top Posters

Top Posters |

| DallasRain | 70421 | | biomed1 | 60603 | | Yssup Rider | 59941 | | gman44 | 52935 | | LexusLover | 51038 | | WTF | 48267 | | offshoredrilling | 47561 | | pyramider | 46370 | | bambino | 40331 | | CryptKicker | 37083 | | Mokoa | 36487 | | Chung Tran | 36100 | | Still Looking | 35944 | | The_Waco_Kid | 35397 | | Mojojo | 33117 |

|

|

03-30-2022, 12:02 PM

03-30-2022, 12:02 PM

|

#16

|

|

Valued Poster

Join Date: Jul 26, 2013

Location: Railroad Tracks, other side thereof

Posts: 6,662

|

Pop goes the home-ownership weasel

Pop goes the home-ownership weasel

I had done a recent analysis, nothing scientific, in another thread.

Here: Shock happens and here: Think bigger

Basically, I was looking for where is the rocky bottom in Austin/RR house prices for rents and acquisition.

I saw a new report out about how rising mortgage rates are already beginning to crush the lower end (young and first time buyers) especially hard.

Biden Crushes Home Ownership for Young Americans

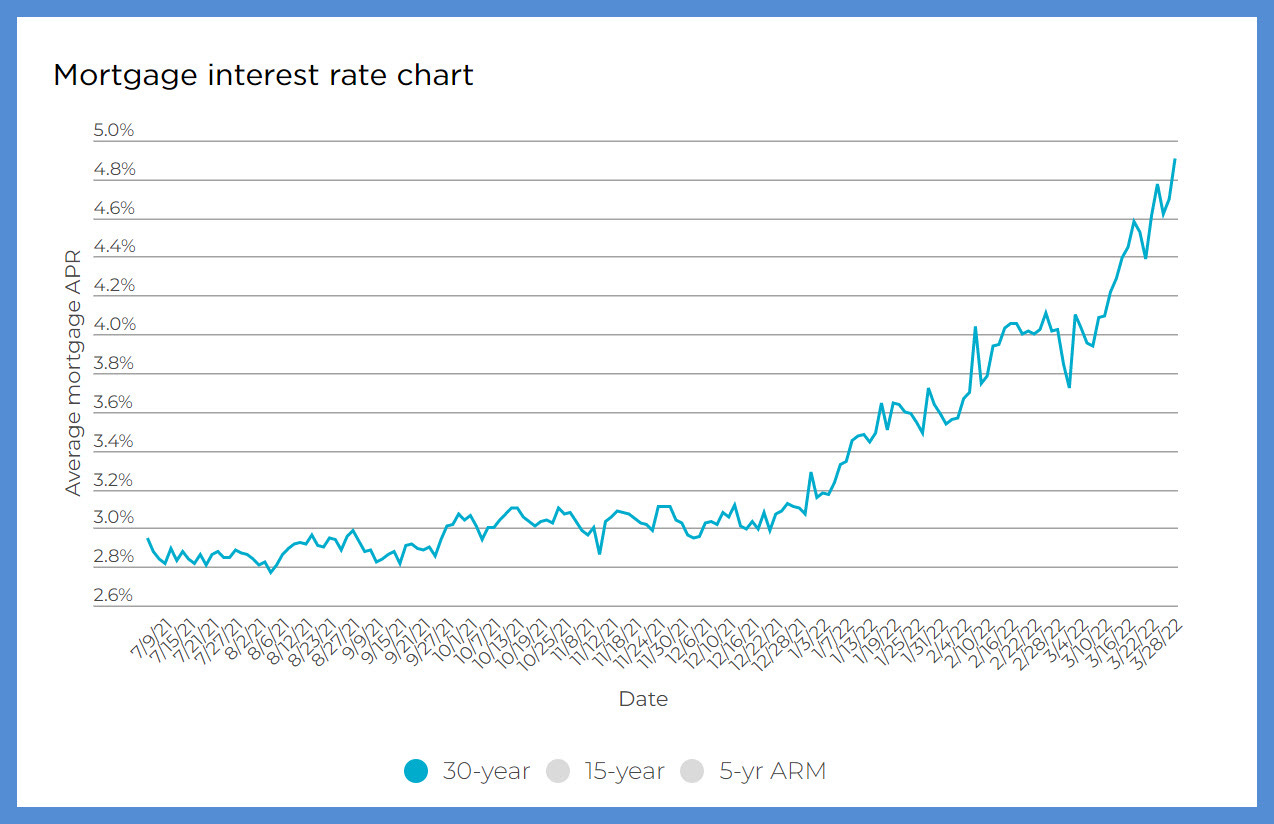

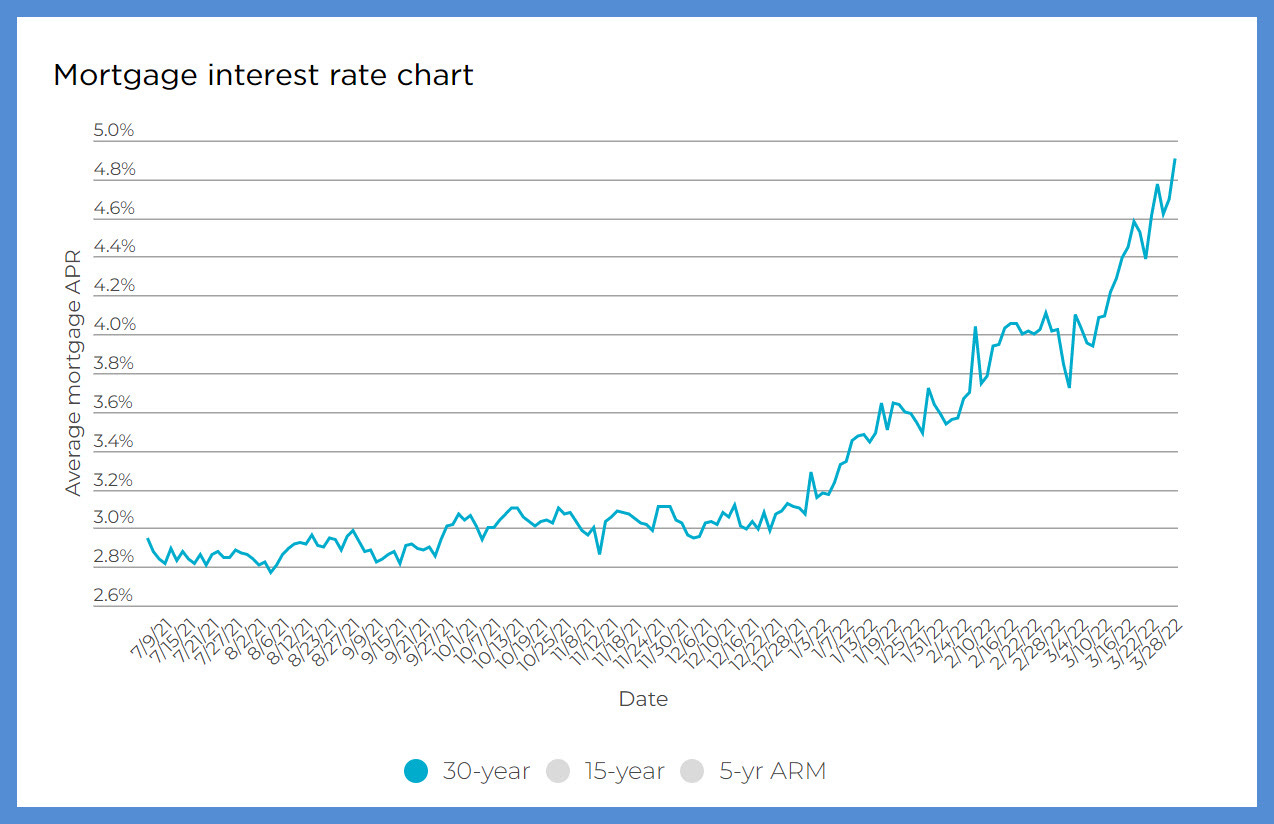

...That spike in inflation compels a massive rise in interest rates which sends the costs of new mortgages soaring. See this chart from Nerd Wallet on the nationwide average for 30-year mortgages, which started this year at 3.25% and now reach nearly 5.0%.

As the chart depicts, the recent vault in mortgage rates is historic and, frankly, jaw-dropping. As Axios reports, just in this month of March, mortgage rates rose over a full percentage point, from 3.76% to 4.95%, the fastest ascent since the 1980s. To put a dollar figure on those percentages, a $2,000 monthly mortgage payment could have financed a $424,000 mortgage at the beginning of March and can now only sustain a $375,000 loan…in a span of just four weeks.

As the chart depicts, the recent vault in mortgage rates is historic and, frankly, jaw-dropping. As Axios reports, just in this month of March, mortgage rates rose over a full percentage point, from 3.76% to 4.95%, the fastest ascent since the 1980s. To put a dollar figure on those percentages, a $2,000 monthly mortgage payment could have financed a $424,000 mortgage at the beginning of March and can now only sustain a $375,000 loan…in a span of just four weeks.

Some dolts will conclude it's either Putin's or Trump's fault.

But we knew that already

|

|

Quote

| 1 user liked this post |

03-30-2022, 12:17 PM

03-30-2022, 12:17 PM

|

#17

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by Tiny

Captain Midnight has suggested buying cheap, out of the money put options as insurance to protect against a bear market. Maybe something to consider.

Could higher interest rates send housing into a spin, since mortgage payments will be higher? Will housing still be tight AF if we get knocked into a recession?

Or since the Fed seems intent on keeping interest rates lower than inflation, will home prices keep going up? Could residential real estate be a good store of value? I’ve got no idea myself.

|

I sold my house in the city and moved to the ag exempted home in the country expecting rates to rise and housebuilding materials to stay high a tad longer than transitory

The cost of shipping was crazy BEFORE oil spiked.

Hell I just sold a 2021 Truck for 3k more than I paid for it a year ago...with 13k miles on it.

Should I blame all these profits on Biden and the greenies?

But I expect it all to come back down at some point...

|

|

Quote

| 1 user liked this post |

03-30-2022, 08:48 PM

03-30-2022, 08:48 PM

|

#18

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,607

|

Quote:

Originally Posted by Why_Yes_I_Do

I had done a recent analysis, nothing scientific, in another thread.

Here: Shock happens and here: Think bigger

Basically, I was looking for where is the rocky bottom in Austin/RR house prices for rents and acquisition.

I saw a new report out about how rising mortgage rates are already beginning to crush the lower end (young and first time buyers) especially hard.

Biden Crushes Home Ownership for Young Americans

...That spike in inflation compels a massive rise in interest rates which sends the costs of new mortgages soaring. See this chart from Nerd Wallet on the nationwide average for 30-year mortgages, which started this year at 3.25% and now reach nearly 5.0%.

As the chart depicts, the recent vault in mortgage rates is historic and, frankly, jaw-dropping. As Axios reports, just in this month of March, mortgage rates rose over a full percentage point, from 3.76% to 4.95%, the fastest ascent since the 1980s. To put a dollar figure on those percentages, a $2,000 monthly mortgage payment could have financed a $424,000 mortgage at the beginning of March and can now only sustain a $375,000 loan…in a span of just four weeks.

As the chart depicts, the recent vault in mortgage rates is historic and, frankly, jaw-dropping. As Axios reports, just in this month of March, mortgage rates rose over a full percentage point, from 3.76% to 4.95%, the fastest ascent since the 1980s. To put a dollar figure on those percentages, a $2,000 monthly mortgage payment could have financed a $424,000 mortgage at the beginning of March and can now only sustain a $375,000 loan…in a span of just four weeks.

Some dolts will conclude it's either Putin's or Trump's fault.

But we knew that already |

Wow! I’m shocked at how little you’re seeing at the low end in the RR area. The working man’s already gotten forced out of Austin.

It sounds like the outlying areas will be next. This is not a good trend.

|

|

Quote

| 1 user liked this post |

03-30-2022, 09:31 PM

03-30-2022, 09:31 PM

|

#19

|

|

Valued Poster

Join Date: Sep 26, 2021

Location: down under Pittsburgh

Posts: 8,922

|

... "Elections have Consequences!" ...

#### Salty

|

|

Quote

| 2 users liked this post |

03-31-2022, 06:05 AM

03-31-2022, 06:05 AM

|

#20

|

|

Valued Poster

Join Date: Jul 26, 2013

Location: Railroad Tracks, other side thereof

Posts: 6,662

|

What goes up does come down. But how does it 'feel'?

What goes up does come down. But how does it 'feel'?

Quote:

Originally Posted by Tiny

Wow! I’m shocked at how little you’re seeing at the low end in the RR area. The working man’s already gotten forced out of Austin.

It sounds like the outlying areas will be next. This is not a good trend.

|

In that thread, some are already considering San Marcos, thus skipping over both Kyle and Buda, to give you a perspective. I was totally caught off-guard on the rocky bottom numbers myself. I still thought $200K and sometimes less was still around, but they would have to be dog-ugly. I ain't-a-skeered of a project house. Gonna keep an eye on them though. Maybe a blip???

I think I had an inkling, but had not actually dove into it. I have heard tales of woe over the past couple years on rent rates climbing and availability and of course the bid-ups on purchases. Let us not forget the diminishing availability and escalating prices on materials and labor to fix up a dog. But now with interest creeping (lurching) upwards, it's a one-two gut punch for some.

Here I agree with WTF (WTF?!?) - it will come down some time, but not at this time. IMHO - the return to sanity trip may well be quite unpleasant.

|

|

Quote

| 2 users liked this post |

03-31-2022, 06:24 AM

03-31-2022, 06:24 AM

|

#21

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,607

|

Quote:

Originally Posted by Why_Yes_I_Do

In that thread, some are already considering San Marcos, thus skipping over both Kyle and Buda, to give you a perspective. I was totally caught off-guard on the rocky bottom numbers myself. I still thought $200K and sometimes less was still around, but they would have to be dog-ugly. I ain't-a-skeered of a project house. Gonna keep an eye on them though. Maybe a blip???

I think I had an inkling, but had not actually dove into it. I have heard tales of woe over the past couple years on rent rates climbing and availability and of course the bid-ups on purchases. Let us not forget the diminishing availability and escalating prices on materials and labor to fix up a dog. But now with interest creeping (lurching) upwards, it's a one-two gut punch for some.

Here I agree with WTF (WTF?!?) - it will come down some time, but not at this time. IMHO - the return to sanity trip may well be quite unpleasant.

|

Interesting. Good post, thanks.

Here are a couple of graphs showing historical prices of construction materials and houses. It looks like other than the period associated with the 2008/2009 recession they've mostly just gone up.

https://fred.stlouisfed.org/series/WPUSI012011

https://fred.stlouisfed.org/series/MSPUS

|

|

Quote

| 1 user liked this post |

03-31-2022, 07:28 AM

03-31-2022, 07:28 AM

|

#22

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by Tiny

Wow! I’m shocked at how little you’re seeing at the low end in the RR area. The working man’s already gotten forced out of Austin.

It sounds like the outlying areas will be next. This is not a good trend.

|

As long as I can afford Salt Lick bbq...it's all good.

That whole Austin San Antoine corridor has been booming.

|

|

Quote

| 1 user liked this post |

03-31-2022, 11:02 AM

03-31-2022, 11:02 AM

|

#23

|

|

Valued Poster

Join Date: Jul 26, 2013

Location: Railroad Tracks, other side thereof

Posts: 6,662

|

Good charts that tell most of the story

Good charts that tell most of the story

Quote:

Originally Posted by Tiny

|

That one on Median Price is interesting, yet telling at the same time. Essentially the rocky-bottom price of $400K is still better than half the country, aka the median. So basically, we are the median and only go up from there.

But the CPI one tells you it is gonna be costly to even buy at the dog pound, i.e. the rocky bottom, with hopes and dreams of making it your fixer project - and that does not even include labor.

Caveat Emptor, juss say'n

|

|

Quote

| 1 user liked this post |

04-02-2022, 06:46 PM

04-02-2022, 06:46 PM

|

#24

|

|

BANNED

Join Date: May 5, 2013

Location: Phnom Penh, Cambodia

Posts: 36,100

|

I don't think a World meltdown is coming, but economic woes are everywhere, as cited in the first post. The FED should have done a 1/2 % raise last month.. Should have done it 5-6 months ago. Powell let rates and stimulus via bond purchases get out of control. We have a good 6 more months of sluggishness before the Economy starts to move forward.

|

|

Quote

| 1 user liked this post |

04-03-2022, 10:44 AM

04-03-2022, 10:44 AM

|

#25

|

|

Valued Poster

Join Date: Oct 1, 2013

Location: Dallas TX

Posts: 12,555

|

yes

|

|

Quote

| 1 user liked this post |

04-03-2022, 01:28 PM

04-03-2022, 01:28 PM

|

#26

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,607

|

Quote:

Originally Posted by Chung Tran

I don't think a World meltdown is coming, but economic woes are everywhere, as cited in the first post. The FED should have done a 1/2 % raise last month.. Should have done it 5-6 months ago. Powell let rates and stimulus via bond purchases get out of control. We have a good 6 more months of sluggishness before the Economy starts to move forward.

|

I don't know as much about macroeconomics as you do, but agree. Captain Midnight would probably disagree with us though about the desirability of more aggressive tightening, and he knows a lot more on this subject than the two of us put together.

|

|

Quote

| 1 user liked this post |

04-03-2022, 08:55 PM

04-03-2022, 08:55 PM

|

#27

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,310

|

"What in the wide, wide world o' sports is a-goin' on here?"

- "Taggart" (Blazing Saddles)

(A lot of people are asking questions like that nowadays!)

My quick take on a couple of points:

B-Dud hits a few key points and gets a lot of things right in the Bloomberg piece, but makes no mention of the fiscal side and how a massive "pivot" is likely to make a whole lot of things look quite different within 6-12 months.

First, note that even center-left economists (like Summers) were saying a year ago that the $1.9 trillion "American Rescue Plan" was way over-the-top and profoundly irresponsible. In fact, taken together with everything else, policymakers were judged to have filled the estimated "output gap" three times over.

About a year ago, JPM put out an analyst's note saying that household bank balances, as a result of the multiple spending surges that dropped cash directly into household accounts, totaled about $2.5 trillion more than the prepandemic trend would have indicated.

That's more than 10% of GDP! Yet RGDP "headline" growth in calendar 2021 was approx. 5.7%. (Doesn't anyone think there's something just a little bit wrong with this picture?)

This year going into next will involve a big-time fiscal "pivot" from an unprecedented level of largesse to comparative budget austerity as the level of deficit spending will necessarily have to be wound down.

I know B-Dud was probably space-limited by Bloomberg editors and didn't have room to go into all this, but believe the fiscal pivot will create even more headwinds for the economy in 2023 than the proposed interest rate hikes.

Remember, too, the last time the Fed began a tightening cycle, in 2018-2019. It didn't go all that well, as it became clear by midyear 2019 that growth was markedly slowing after a series of 25-bippers over a multi-year period took the effective funds rate to about 2.4% at the peak. Then the Fed came under pressure to reverse course and lower rates, and then had to suddenly infuse a few truckloads of cash during the REPO freakout of September 2019.

https://en.wikipedia.org/wiki/Septem...S._repo_market

(As far as I know, whoever wrote the Wikipedia entry above had a pretty good take on the series of events.)

If the cycle couldn't ride all that well in the second half of 2019 after taking the "training wheels" off, who in the hell actually thinks it's likely to do so over the next 12-18 months?

For it should be plain for everyone to see that almost every elemental piece that makes up the macroeconomy is in much, much worse shape than it was three years ago.

.

|

|

Quote

| 4 users liked this post |

04-04-2022, 05:36 AM

04-04-2022, 05:36 AM

|

#28

|

|

Valued Poster

Join Date: Jul 26, 2013

Location: Railroad Tracks, other side thereof

Posts: 6,662

|

We... are not alone

We... are not alone

Quote:

Originally Posted by Chung Tran

I don't think a World meltdown is coming, but economic woes are everywhere, as cited in the first post. The FED should have done a 1/2 % raise last month.. Should have done it 5-6 months ago. Powell let rates and stimulus via bond purchases get out of control. We have a good 6 more months of sluggishness before the Economy starts to move forward.

|

Kinda wish the world felt the same way as your sentiment. But uhhmmm.. it don't. The FED should -- never mind, not going there is this thread at this time.

The same issues we are seeing are simulcast around the planet. Though odd as it may sound at first blush -- all the places experiencing the most pain points are all-in on the Build Back Better (BBB) Bandwagon. Daaahhh... probably just a freakish coincidence. Right?

|

|

Quote

| 1 user liked this post |

04-04-2022, 06:12 AM

04-04-2022, 06:12 AM

|

#29

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by CaptainMidnight

Remember, too, the last time the Fed began a tightening cycle, in 2018-2019. It didn't go all that well, as it became clear by midyear 2019 that growth was markedly slowing after a series of 25-bippers over a multi-year period took the effective funds rate to about 2.4% at the peak. Then the Fed came under pressure to reverse course and lower rates, and then had to suddenly infuse a few truckloads of cash during the REPO freakout of September 2019.

https://en.wikipedia.org/wiki/Septem...S._repo_market

(As far as I know, whoever wrote the Wikipedia entry above had a pretty good take on the series of events.)

. |

I'll venture to guess it wasn't lustylad , he was squawking about 3-4% GDP numbers at the time!

May I suggest all your post start with a Blazing Saddles quote!

"Doggone Near Lost A Four Hundred Dollar Hand Cart:

|

|

Quote

| 1 user liked this post |

04-04-2022, 08:09 AM

04-04-2022, 08:09 AM

|

#30

|

|

Valued Poster

Join Date: Jul 26, 2013

Location: Railroad Tracks, other side thereof

Posts: 6,662

|

That'll leave a hickey on ya

That'll leave a hickey on ya

Quote:

Originally Posted by Tiny

Wow! I’m shocked at how little you’re seeing at the low end in the RR area. The working man’s already gotten forced out of Austin.

It sounds like the outlying areas will be next. This is not a good trend.

|

I totally forgot to mention the new $17B Samsung chip plant being built in Taylor. So it's more of a pincer move than a push out.

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|