Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

650 |

| MoneyManMatt |

490 |

| Jon Bon |

408 |

| Still Looking |

399 |

| samcruz |

399 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| George Spelvin |

339 |

| Starscream66 |

314 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| You&Me |

281 |

| sharkman29 |

270 |

|

Top Posters

Top Posters |

| DallasRain | 71605 | | biomed1 | 71113 | | Yssup Rider | 64042 | | gman44 | 56015 | | LexusLover | 51038 | | offshoredrilling | 50515 | | WTF | 48272 | | bambino | 47466 | | pyramider | 46457 | | The_Waco_Kid | 41998 | | Dr-epg | 39145 | | CryptKicker | 37454 | | Mokoa | 36517 | | Chung Tran | 36100 | | Still Looking | 35944 |

|

|

05-23-2022, 08:52 AM

05-23-2022, 08:52 AM

|

#361

|

|

Enano Poderoso

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,982

|

Quote:

Originally Posted by lustylad

Really? The "biggest wealth shift in US history"? Where did you hear that? Got a link for us, chungy?

I do know we're now discovering how all those emergency covid relief bills resulted in the most massive fraud/heists of US taxpayer money in our history. We're talking hundreds of billions here. And I've got plenty of links attesting to that fact, if you're interested. Never let a crisis go to waste, eh chungy?

Not sure how you can say with a straight face all that fraud and abuse benefited ME. How does the rampant ripping off of US taxpayers by fraudsters around the globe help me or any of my fellow citizens? One thing is for sure - it helped spike inflation, which has exploded from 1.4% when Biden took office to over 8% now, measured by the 12-month CPI increase.

That's not a beneficial "wealth shift". Quite the contrary. It means wages earned by low-paid workers are shrinking in purchasing power (unlike under Trump), despite a labor shortage that keeps pushing up their nominal pay. But if I had to say one good thing about Joe Biden's inflation fiasco, it would be - IT DOESN'T DISCRIMINATE. Whether you're white, black, brown or yellow - we're all being slammed!

|

Really a good post. The GDP numbers and your thoughts in the blue print (not quoted here) are enlightening. You might be a wee bit hard on Chung Tran. Without him you wouldn't have written this.

|

|

Quote

| 1 user liked this post |

05-23-2022, 09:23 AM

05-23-2022, 09:23 AM

|

#362

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,272

|

Quote:

Originally Posted by Tiny

Really a good post. The GDP numbers and your thoughts in the blue print are enlightening. You might be a wee bit hard on Chung Tran. Without him you wouldn't have written this.

|

Written that misleading bullshit. Yes inflation was low in January of 2021 but savings had spiked and there was spent up demand. We were open up the country and the world.

Your hero is a political hack who is trying to fit the facts to a political agenda.

Anyone with half a brain could see what was going to happen.

The suprise has been the lack of investment in drilling and the Ukraine war which has shifted countries from looking to buy oil efficiently to looking to buy oil from any country other than Russia.

Who has that benefited? Venezuela and Iran and energy investors!

There are many other supply chain problems. Do you think autos would be costing what they are without the chip shortage? I bought a truck in December of 2020 and got 10k off MRSP. I sold it in January of 2022 for 3k more than I bought it after putting 14k miles on it. Is that Bidens fault? I bought a 2022 truck in in January and had to pay sticker. Now they gave me a great trade in price for a 2016 truck I had. And now I see where they are sticking an extra 3-5k on sticker prices to new trucks! Is that Bidens fault?

The 1.9 trillion was bipartisan if memory serves me. Wasn't it a infrastructure bill?

The 3.5 trillion dollar Build Back Better did not get passed. Despite your fear.

So in retrospect....we had first Trump and then Biden giving massive amounts of stimulus money to consumers. You had a huge world wide pent up demand. What did you expect was going to happen. Did you expect inflation while Trump was in office when demand was still low? Maybe Chang is right to point the finger at the Fed but in their defense....how could they raise rates before the economy started heating up. Look what happened in 2018 when they tried to raise rates.

I believe in business cycles and am not as big a believer in the assignment of praise or blame to any one political party.

I know that is a minority opinion in this forum. Especially from you Reagan disciples! Y'all can't even acknowledge when the debt to GDP ratio started expanding and the idea that debt doesn't matter originated!

|

|

Quote

| 1 user liked this post |

05-23-2022, 09:30 AM

05-23-2022, 09:30 AM

|

#363

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,272

|

Quote:

Originally Posted by Why_Yes_I_Do

Firstly, I had taken Chungy's post as sarcastic. RE: The poor young'un who, as I said, was now living on a street corner in San Fran Nan's district. I talked with a few Millennials (I own quite a few) who were shocked - SHOCKED I say - when the '08-'09 bubble popped and the stock market went down hard. It was the first time in their pseudo-adult life it had happened.

Secondly, I fairly well agree with the Chunger that the Fed should have stepped up much earlier and that is a big part of the problem. IMHO it was full political, i.e. not raising rates in an election year.

Thirdly and the most importantly part - Trump taught us the absolutely most important financial/economic lesson in the entire history of US and World policy - You do NOT, I mean EVER, shutdown a roaring economy by slamming on the brakes - even if some asshat Doctors (Fauci, Birks) and a dipshit fake academic with their bullshit models of carnage (Neil Furguson) and a China aligned WHO says so.

Sure, one can try to reprime the pump (engine) after it shut down, might even be reasonable to expect it could work - for the first time ever. But that has consequences that are based in reality. I posted The Bernank article the other day (Houston we have a problem?). The Fed don't have that many tools and shuttering an entire economy is NOT standard Bill of Fare to have to deal with.

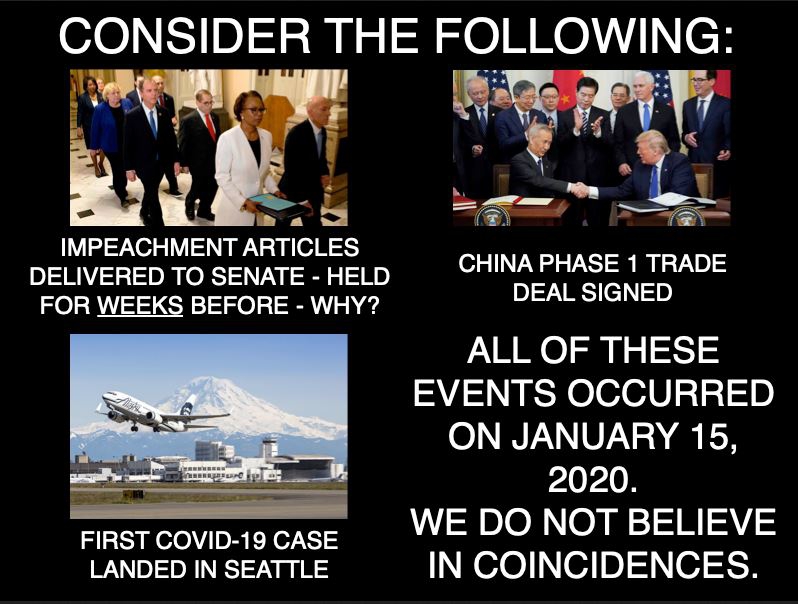

I did not know it at the time, but I see January 15, 2020 as the day of the apocalypse. That's when we got Proper F*cked. How we get un-F*cked, I know not. But I sure hope it involves kicking a shit-tonne of politicos to the same street corner as Chungy's Millennial fellow.

Being the pragmatic person that I am, I am mainly interested in how best to position myself to profit from the opportunity foisted upon us all, as I had managed some reasonable levels of protection during the recent-past economic Greek session.

Essentially, trying to look forward versus in the rear view mirror. Or as Ensio Ferrari once said: That which is behind me does not concern me. And that's all I have to say about that.

|

Other than the minor Conspiracy theory aspect there trying to alleviate Trump of any responsibility....I approve this message.

Many of you are looking at this with the benefit of hindsight and even at that expecting say the Fed to do something that wasn't possible given the political environment.

|

|

Quote

| 1 user liked this post |

05-23-2022, 09:33 AM

05-23-2022, 09:33 AM

|

#364

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,272

|

Quote:

Originally Posted by Tiny

Yes and no, respectively. And I don’t think the price of oil was low in 2019.

|

You would have if you were invested in energy!

|

|

Quote

| 1 user liked this post |

05-23-2022, 09:57 AM

05-23-2022, 09:57 AM

|

#365

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,272

|

Watching CNBC and they just had a segment that we have added 40 trillion in wealth in the market since the pandemic and have only dropped 5 trillion of that wealth...

Their point was the Fed may have to go higher faster.

|

|

Quote

| 1 user liked this post |

05-23-2022, 10:27 AM

05-23-2022, 10:27 AM

|

#366

|

|

BANNED

Join Date: Jul 26, 2013

Location: Railroad Tracks, other side thereof

Posts: 8,522

|

ISO: Crisis level mental health eval

ISO: Crisis level mental health eval

Quote:

Originally Posted by WTF

Other than the minor Conspiracy theory aspect there trying to alleviate Trump of any responsibility....I approve this message. ..

|

WTF?!? WTF agrees with me?!? HELP! HELP! Call a Doctor. STAT!

I do blame Trump and I bet Trump does as well - For not going with his gut on the pandemic reaction. His core strength was finance not health. Clearly he built a great deal of wealth by understanding finance, markets and marketing. Sure, the typical azz-hats can argue typical azz-hat positions. It's what they do

But nobody can claim health or even healthy eating were his strong suits. He over-rode his financial instincts after months of cajoling (as I stated). I bet he still kicks himself for that even. Trump as a health and medical advisor? Imma say Nope!

|

|

Quote

| 1 user liked this post |

05-23-2022, 10:42 AM

05-23-2022, 10:42 AM

|

#367

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,410

|

Color me nonplussed!

Color me nonplussed!

Quote:

Originally Posted by dilbert firestorm

you must be using long scale. Huh??

however, I cannot find any reference to '1 million billion' calle that.

10^15 = 1,000,000,000,000,000 is million billion which is quadrillion which is also thousand billion.

|

I have no idea what point you may be trying to make, or whether there even is one. All I did was point out earlier that a quadrillion is NOT a thousand billion. (Which should be flatly obvious to you if you so much as took a glance at the link you posted, and at my reply.)

How you could seem so confused by this must surely be a mystery to everyone who read this post!

.

|

|

Quote

| 1 user liked this post |

05-23-2022, 10:42 AM

05-23-2022, 10:42 AM

|

#368

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,410

|

How the "wealth effect works" -- (in both directions!)

How the "wealth effect works" -- (in both directions!)

Quote:

Originally Posted by WTF

The 1.9 trillion was bipartisan if memory serves me. Wasn't it a infrastructure bill?

|

No. The "infrastructure bill" was an entirely different piece of legislation, passed in November. It was somewhat bipartisan, with more than two-thirds of the Senate voting for it.

The $1.9 trillion inflation-driving blowout that answers to the name of the "American Rescue Plan" was passed along party lines back in March 2021. (Note that unlike the "infrastructure bill," it poured big dollars into the economy almost immediately.)

Quote:

Originally Posted by WTF

Watching CNBC and they just had a segment that we have added 40 trillion in wealth in the market since the pandemic and have only dropped 5 trillion of that wealth...

Their point was the Fed may have to go higher faster.

|

I suspect they were referring to the following concept:

The $40 trillion of net worth increase aggregates all types of assets (houses, stocks, plus everything else).

It's expected that negative wealth effect dynamics will cool consumption if households "feel" poorer. Economists for generations have studied the "wealth effect," whereby households are more confident and likely to spend more if they think their houses (or stocks) have gone up in value -- even if they think they have no intention of selling them anytime soon!

Although it's uncertain and varies across time, it's generally assumed that the "wealth effect" can induce consumption increases of 3-4% of every perceived dollar of net worth appreciation (or decreases when households feel their assets have fallen in market value).

The wealth effect is more powerful in the housing market than the equity markets, for obvious reasons. (Due to the far greater portion of financial assets owned by affluent households with much lower marginal propensity to consume).

Investors expect and generally are prepared for equity market declines.

However, if rapidly rising mortgage interest rates whack the housing market by more than a tiny bit, millions of homeowners are going to be mighty unhappy, and likely to take out their anger when it comes time to head to the polls!

.

|

|

Quote

| 1 user liked this post |

05-23-2022, 11:19 AM

05-23-2022, 11:19 AM

|

#369

|

|

Enano Poderoso

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,982

|

Quote:

Originally Posted by WTF

Written that misleading bullshit. Yes inflation was low in January of 2021 but savings had spiked and there was spent up demand. We were open up the country and the world.

|

Let's look at what happened. In March, 2020, Congress and Trump passed the CARES act, which provided for $1200 payments to adults and $500 to children, along with PPP loans, extra unemployment benefits and the like. The amount of money Americans sock away on a monthly basis as a percentage of disposable personal income rose up to 33.8%. But by December, 2020, personal saving was on a sustained downward trend, back towards historical levels. More importantly, YoY inflation was only 1.4%. At that point, Trump and Pelosi got through another spending bill, $600 per person, in December, 2020. If not for McConnell and Senate Republicans, the stimulus payments would have been $2000 per person. As Lusty Lad noted, GDP expanded at a torrid QoQ annualized rate in 3Q2020, and at about a 4% annualized rate in 4Q2020. We were back on our way to normalcy. Then Biden and Democratic Congressmen, in a party line vote, forced through the American Rescue Plan in March, 2021, with $1400 stimulus payments per adult AND per child, along with a host of other payments to advance Democratic Party priorities. That was huge compared to the December, 2020 payments. The rest is history. The ARP was like pouring gasoline on a slow burning fire.

See the links in post 314 in this thread for graphs and tables on government web sites for backup.

Quote:

Originally Posted by WTF

Your hero is a political hack who is trying to fit the facts to a political agenda.

|

Lusty Lad is pretty smart.

Quote:

Originally Posted by WTF

The suprise has been the lack of investment in drilling and the Ukraine war which has shifted countries from looking to buy oil efficiently to looking to buy oil from any country other than Russia.

|

As you have correctly noted, this is because private equity, Wall Street, and the companies themselves weren't investing. Why? Well, part of the reason is because the Democratic Party made investing in energy politically incorrect. And not only that. Look at Biden's 2020 campaign promise to end drilling on federal lands and the federal offshore. And promises by Warren, Sanders et al to immediately ban hydraulic fracturing. The Democratic Party is an existential threat to the oil and gas industry. And looking at the demographic changes occurring in America, in particular more Millenials voting and more Baby Boomers dying, the future looks bright for the Party. That said, you were also correct, that investors want to see free cash flow from their investments in energy, and when companies invest too much to increase production and reserves, there is no free cash flow.

Quote:

Originally Posted by WTF

There are many other supply chain problems. Do you think autos would be costing what they are without the chip shortage? I bought a truck in December of 2020 and got 10k off MRSP. I sold it in January of 2022 for 3k more than I bought it after putting 14k miles on it. Is that Bidens fault? I bought a 2022 truck in in January and had to pay sticker. Now they gave me a great trade in price for a 2016 truck I had. And now I see where they are sticking an extra 3-5k on sticker prices to new trucks! Is that Bidens fault?

|

Yes it is, partly. Biden could remove tariffs, in particular the tariffs on Chinese goods that are gumming up supply chains. Not only would that alleviate the chip shortage and the like, but it would bring down prices of imports, and help bring down inflation.

Quote:

Originally Posted by WTF

The 1.9 trillion was bipartisan if memory serves me. Wasn't it a infrastructure bill?

|

See Captain Midnight's post, above. No it was not. In fact it crowded out spending for infrastructure and the like. Larry Summer's biggest criticism of the American Rescue Plan was, "there is a chance that macroeconomic stimulus on a scale closer to World War II levels than normal recession levels will set off inflationary pressures of a kind we have not seen in a generation, with consequences for the value of the dollar and financial stability." His second biggest criticism was, "If the stimulus proposal is enacted, Congress will have committed 15 percent of GDP with essentially no increase in public investment to address these challenges (Tiny's note: like infrastructure). After resolving the coronavirus crisis, how will political and economic space be found for the public investments that should be the nation’s highest priority?"

Quote:

Originally Posted by WTF

The 3.5 trillion dollar Build Back Better did not get passed. Despite your fear.

|

Thanks as you said to the Senators from West Virginia and Arizona.

Quote:

Originally Posted by WTF

I believe in business cycles and am not as big a believer in the assignment of praise or blame to any one political party.

|

I think you're a little worse than me. You've expended a lot of energy trying to show that GDP growth is better under Democratic than Republican presidents anyway.

Quote:

Originally Posted by WTF

I know that is a minority opinion in this forum. Especially from you Reagan disciples! Y'all can't even acknowledge when the debt to GDP ratio started expanding and the idea that debt doesn't matter originated!  |

Reagan was the greatest American president during our lifetimes. Except for LexusLover's. He was probably around during Calvin Coolidge's terms.

|

|

Quote

| 1 user liked this post |

05-23-2022, 11:23 AM

05-23-2022, 11:23 AM

|

#370

|

|

Enano Poderoso

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,982

|

Quote:

Originally Posted by WTF

You would have if you were invested in energy!  |

I am invested in energy. Probably overinvested.

|

|

Quote

| 1 user liked this post |

05-23-2022, 12:09 PM

05-23-2022, 12:09 PM

|

#371

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,410

|

Here are a couple of reasons why lower middle- and working-class households may be strapped by declining real disposable income even more than widely assumed, and this could result in an increasingly aroused electorate during the next year or so.

First, there is no 1970s-style "wage-price" spiral happening like it was during the '70s. There's not even a wage spiral, since even with a sub-4% unemployment rate, nominal wage growth has actually been slowing. Consequently, real wage growth has been slowing even faster as inflation has not abated.

Contrast that with the 1970s "stagflation era," when during the roughly 80% of the time that the economy was not actually contracting, wage growth exceeded CPI growth about 50% of the time. That's why we had what was referred to as a "wage-price spiral." (This wasn't a great time for lower-income American workers, but it was better than what most experience today.)

Second, the way the CPI is calculated underweights the goods basket items consisting of necessities that lower income households must have rather than would just like to have.

Related to this is the way in which "hedonic quality" adjustments are used to try to justify the view that you're better off with products that have a lot of frills and technological capabilities, whether or not you need (or even want) these features.

For instance, what if a family on a tight budget just wants a very basic, stripped down car for basic transportation.

Here is a good description from 2019 about how this works:

https://wolfstreet.com/2019/10/07/st...three-decades/

.

|

|

Quote

| 1 user liked this post |

05-23-2022, 01:04 PM

05-23-2022, 01:04 PM

|

#372

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,272

|

Quote:

Originally Posted by CaptainMidnight

No. The "infrastructure bill" was an entirely different piece of legislation, passed in November. It was somewhat bipartisan, with more than two-thirds of the Senate voting for it.

The $1.9 trillion inflation-driving blowout that answers to the name of the "American Rescue Plan" was passed along party lines back in March 2021. (Note that unlike the "infrastructure bill," it poured big dollars into the economy almost immediately.)

I suspect they were referring to the following concept:

The $40 trillion of net worth increase aggregates all types of assets (houses, stocks, plus everything else).

It's expected that negative wealth effect dynamics will cool consumption if households "feel" poorer. Economists for generations have studied the "wealth effect," whereby households are more confident and likely to spend more if they think their houses (or stocks) have gone up in value -- even if they think they have no intention of selling them anytime soon!

Although it's uncertain and varies across time, it's generally assumed that the "wealth effect" can induce consumption increases of 3-4% of every perceived dollar of net worth appreciation (or decreases when households feel their assets have fallen in market value).

The wealth effect is more powerful in the housing market than the equity markets, for obvious reasons. (Due to the far greater portion of financial assets owned by affluent households with much lower marginal propensity to consume).

Investors expect and generally are prepared for equity market declines.

However, if rapidly rising mortgage interest rates whack the housing market by more than a tiny bit, millions of homeowners are going to be mighty unhappy, and likely to take out their anger when it comes time to head to the polls!

.

|

I stand corrected....which is why I asked!

Next

That was exactly what they were talking about.

I just read a good article on why this housing bubble will not be as bad as the last. I'll come back and post the link.

Personally I believe the price of gas/energy will have the largest effect on the midterm elections. Which is why I think the Dems will get rolled!

|

|

Quote

| 1 user liked this post |

05-23-2022, 01:08 PM

05-23-2022, 01:08 PM

|

#373

|

|

Enano Poderoso

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,982

|

Quote:

Originally Posted by CaptainMidnight

However, if rapidly rising mortgage interest rates whack the housing market by more than a tiny bit, millions of homeowners are going to be mighty unhappy, and likely to take out their anger when it comes time to head to the polls!

.

|

Quote:

Originally Posted by CaptainMidnight

Here are a couple of reasons why lower middle- and working-class households may be strapped by declining real disposable income even more than widely assumed, and this could result in an increasingly aroused electorate during the next year or so....

|

Thanks, honestly, I hadn't thought about either of those points.

I have a couple of financial decisions to make that hinge on whether the Republicans take back the House this year, or the Democrats retain control and add to their majority in the Senate. As WTF correctly said, I tend to wet my pants a lot, figuratively speaking, worrying about things that may never come to pass. I've fixated on the effect on the electorate of the upcoming Supreme Court Decision on abortion and Trump's involvement in the midterms. But if people are thinking mainly about their pocket books, then yes, the Republicans should take back the House.

|

|

Quote

| 1 user liked this post |

05-23-2022, 01:10 PM

05-23-2022, 01:10 PM

|

#374

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,272

|

Quote:

Originally Posted by Tiny

I am invested in energy. Probably overinvested.

|

No such thing as over invested in energy at the moment!

That could change overnight but it looks like China is opening back up...that should drive up prices. But Iran and Venezuela are supposedly ramping up. That will eventually lead to lower prices , especially if Putin comes to his senses! If we only had a crystal ball.

|

|

Quote

| 1 user liked this post |

05-23-2022, 01:13 PM

05-23-2022, 01:13 PM

|

#375

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,272

|

Quote:

Originally Posted by Tiny

. But if people are thinking mainly about their pocket books, then yes, the Republicans should take back the House.

|

You can bet your life savings on it....which in lustylad's case is an autographed Milton Friedman book and a Barbie Doll house from his youth!

And on a side note...the bill passed on March of 2021 was talked up by Republicans, who then voted against it! And Trump was 100% behind.

If you think for one second that I'm falling for that "Republicans are spendthrifts who will lower the deficit (except when a Democrat is in office)" ever again, you are wack!

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|