Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

650 |

| MoneyManMatt |

490 |

| Jon Bon |

408 |

| Still Looking |

399 |

| samcruz |

399 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| George Spelvin |

339 |

| Starscream66 |

315 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| You&Me |

281 |

| sharkman29 |

270 |

|

Top Posters

Top Posters |

| DallasRain | 71607 | | biomed1 | 71160 | | Yssup Rider | 64077 | | gman44 | 56034 | | LexusLover | 51038 | | offshoredrilling | 50537 | | WTF | 48272 | | bambino | 47596 | | pyramider | 46457 | | The_Waco_Kid | 42033 | | Dr-epg | 39220 | | CryptKicker | 37455 | | Mokoa | 36518 | | Chung Tran | 36100 | | Still Looking | 35944 |

|

|

11-28-2025, 09:42 PM

11-28-2025, 09:42 PM

|

#16

|

|

Lifetime Premium Access

Join Date: Apr 25, 2009

Location: sa tx usa

Posts: 16,903

|

Doggy.

Came in like a howling wolf.

Left like a scolded puppy.

There remaining effect is like a piss stained, shit smelling room with all the furniture torn up.

|

|

Quote

| 1 user liked this post |

11-30-2025, 03:26 PM

11-30-2025, 03:26 PM

|

#17

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,410

|

The Triumph of Politics Over Economics, Chapter (whatever in the hell it is now!)

The Triumph of Politics Over Economics, Chapter (whatever in the hell it is now!)

Quote:

Originally Posted by Tiny

Theoretically, couldn't Republicans right size federal government next year in a budget reconciliation bill? Practically Congressmen don't have the stomach for it, and I don't think Trump does either.

|

They certainly could give it a try! But just look at what they did when crafting the so-called "big, beautiful bill." With the exception of just a few conservatives, they demonstrated beyond any reasonable doubt that they think budget-busting recklessness is perfectly fine as long as Democrats aren't doing it! During the run-up to passage, there were a few objections, but Donald and his congressional allies told the conservatives where they could stick it in no uncertain terms.

In the WSJ piece lustylad posted, the author relates that he commissioned David Stockman, Reagan's budget director during his first term, to map out a way forward. However, Stockman must have realized the gravity of the challenge, since his own efforts in the early 1980s were effectively blockaded by the big-spenders in Congress.

Here's the transcript of a very interesting interview he did with Reason's Nick Gillespie almost 15 years ago:

https://reason.com/2011/03/21/the-tr...litics-over-e/

And the fiscal outlook has only gotten worse since then.

Much, much worse.

|

|

Quote

| 4 users liked this post |

12-01-2025, 10:35 AM

12-01-2025, 10:35 AM

|

#18

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: Austin Texas

Posts: 6,020

|

Quote:

Originally Posted by Texas Contrarian

They certainly could give it a try! But just look at what they did when crafting the so-called "big, beautiful bill." With the exception of just a few conservatives, they demonstrated beyond any reasonable doubt that they think budget-busting recklessness is perfectly fine as long as Democrats aren't doing it! During the run-up to passage, there were a few objections, but Donald and his congressional allies told the conservatives where they could stick it in no uncertain terms.

In the WSJ piece lustylad posted, the author relates that he commissioned David Stockman, Reagan's budget director during his first term, to map out a way forward. However, Stockman must have realized the gravity of the challenge, since his own efforts in the early 1980s were effectively blockaded by the big-spenders in Congress.

Here's the transcript of a very interesting interview he did with Reason's Nick Gillespie almost 15 years ago:

https://reason.com/2011/03/21/the-tr...litics-over-e/

And the fiscal outlook has only gotten worse since then.

Much, much worse. |

Democrats usually believe that the Government should spend during recessions and tax during bull markets.

Republicans tend to spend regardless of the economy and lower taxes in the mistaken belief that the improved economy will generate enough tax revenue to sustain the tax cuts.

If we’re going to get out of our deficit hole the first step should be an increased tax across the board and a restructuring of the tax system to include a government provided efile system, and the repeal of the most egregious tax loopholes we have.

Last but not least we need to have a realistic discussion on inheritance taxes. It doesn’t need to be excessive but we definitely need one. In my opinion too many people are avoiding the estate tax.

|

|

Quote

| 2 users liked this post |

12-01-2025, 10:28 PM

12-01-2025, 10:28 PM

|

#19

|

|

Enano Poderoso

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,984

|

Quote:

Originally Posted by txdot-guy

Democrats usually believe that the Government should spend during recessions and spend more during bull markets.

|

Fixed that for you (red text)

Quote:

Originally Posted by txdot-guy

...the first step should be...the repeal of the most egregious tax loopholes we have.

|

We agree. Please tell that to Chuck Schumer. He's historically always buried efforts to end the most egregious, carried interest for fund managers, in committee.

Quote:

Originally Posted by txdot-guy

Last but not least we need to have a realistic discussion on inheritance taxes. It doesn’t need to be excessive but we definitely need one. In my opinion too many people are avoiding the estate tax.

|

It's already excessive. Taking 40% of everything a person owned is way excessive. It's so excessive that most people who would be affected take steps that make little economic sense to avoid it. The wealthy can loan money to their children and sell their assets to them over long periods of time. The really wealthy have no option except to give it away to charity, to keep the bastards in Washington from taking it. If I were to ever get really wealthy, I'd create a 501(c)(3) charity, the Fuck Elizabeth Warren Fund, which would work on ways to fuck over Elizabeth Warren, and give my billions to it. That's how I'd avoid the estate tax.

|

|

Quote

| 1 user liked this post |

12-02-2025, 08:31 AM

12-02-2025, 08:31 AM

|

#20

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: Austin Texas

Posts: 6,020

|

Quote:

Originally Posted by txdot-guy

Democrats usually believe that the Government should spend during recessions and spend more during bull markets.

Republicans tend to spend regardless of the economy and lower taxes in the mistaken belief that the improved economy will generate enough tax revenue to sustain the tax cuts.

|

Quote:

Originally Posted by Tiny

Fixed that for you (red text)

|

There has been government deficit spending since 1969 except during the end of Clinton’s Presidency and the beginning of Bush’s presidency. (Bush’s tax cuts ended that)

The point I was trying to make and you apparently missed is that except some spending madness under Biden democrats aren’t under the delusion that tax cuts raise revenue.

There are plenty of ways in which we can start to fix our deficit problems but tax cuts are not the solution anymore than the idea that excessive spending doesn’t contribute to inflation.

https://www.davemanuel.com/history-o...ted-states.php

Deficit spending by year.

|

|

Quote

| 2 users liked this post |

12-02-2025, 01:35 PM

12-02-2025, 01:35 PM

|

#21

|

|

Enano Poderoso

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,984

|

Quote:

Originally Posted by txdot-guy

There has been government deficit spending since 1969 except during the end of Clinton’s Presidency and the beginning of Bush’s presidency. (Bush’s tax cuts ended that)

The point I was trying to make and you apparently missed is that except some spending madness under Biden democrats aren’t under the delusion that tax cuts raise revenue.

There are plenty of ways in which we can start to fix our deficit problems but tax cuts are not the solution anymore than the idea that excessive spending doesn’t contribute to inflation.

https://www.davemanuel.com/history-o...ted-states.php

Deficit spending by year. |

But tax cuts can raise revenue TxDot. The revenue maximizing tax rate for the corporate income tax is around 26%, not the 35%+ (plus state income tax) prior to the Ryan/McConnell/ Trump tax cut. The cut in the corporate income tax did lower government revenues for several years. But in the long run it should increase government revenues significantly, especially when you take into account the higher social security and Medicare payroll contributions. The Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) have historically assumed the revenue maximizing capital gains tax rate is in the high 20's, much lower than the 43.4% favored recenlty by many Democratic Party politicians. Those conclusions aren't from Fox News, but rather economists at the CBO, JCT, National Bureau of Economic Research, and Ivy League universities.

I'll add that Texas Contrarian made a compelling case here that Reagan and Congressional Democrats actually increased revenues when they cut the maximum tax rate and made loopholes less attractive.

Thanks for the link. I didn't realize that Republicans presidents were in office for so many years when we were running budget surpluses. Yes, Calvin Coolidge was a great man.

And yes, Bill Clinton and a Republican Congress did great things during Clinton's 2nd term. That wouldn't have happened without the Republicans. I believe presidential administrations and Congresses since then sucked in comparison.

|

|

Quote

| 2 users liked this post |

12-02-2025, 04:51 PM

12-02-2025, 04:51 PM

|

#22

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: Austin Texas

Posts: 6,020

|

Quote:

Originally Posted by Tiny

But tax cuts can raise revenue TxDot. The revenue maximizing tax rate for the corporate income tax is around 26%, not the 35%+ (plus state income tax) prior to the Ryan/McConnell/Trump tax cut. The cut in the corporate income tax did lower government revenues for several years. But in the long run it should increase government revenues significantly, especially when you take into account the higher social security and Medicare payroll contributions. The Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) have historically assumed the revenue maximizing capital gains tax rate is in the high 20's, much lower than the 43.4% favored recenlty by many Democratic Party politicians. Those conclusions aren't from Fox News, but rather economists at the CBO, JCT, National Bureau of Economic Research, and Ivy League universities.

I'll add that Texas Contrarian made a compelling case here that Reagan and Congressional Democrats actually increased revenues when they cut the maximum tax rate and made loopholes less attractive.

Thanks for the link. I didn't realize that Republicans presidents were in office for so many years when we were running budget surpluses. Yes, Calvin Coolidge was a great man.

And yes, Bill Clinton and a Republican Congress did great things during Clinton's 2nd term. That wouldn't have happened without the Republicans. I believe presidential administrations and Congresses since then sucked in comparison.

|

Tax cuts can provide the economy with growth that can offset the tax cuts but that rarely happens. Tax cuts are only effective for broad economic growth when the economy needs the extra stimulus. Right now our economy is swimming in cash that is being invested in crypto and the AI boom. That extra tax money would be put to much better use in offsetting the extra interest we’re paying on our u.s. debt payments or funding social security.

|

|

Quote

| 3 users liked this post |

12-02-2025, 10:39 PM

12-02-2025, 10:39 PM

|

#23

|

|

Enano Poderoso

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,984

|

Quote:

Originally Posted by txdot-guy

Right now our economy is swimming in cash that is being invested in crypto and the AI boom. That extra tax money would be put to much better use in offsetting the extra interest we’re paying on our u.s. debt payments or funding social security.

|

I don't agree with the first part of your post. As to the last part, quoted above, it's a brilliant argument. Keep it up and you might just be able to step in the ring with TC or LL and not get your ass kicked, which is more than can be said for me.

|

|

Quote

| 2 users liked this post |

12-04-2025, 12:01 AM

12-04-2025, 12:01 AM

|

#24

|

|

Lifetime Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 20,087

|

Quote:

Originally Posted by Texas Contrarian

They certainly could give it a try! But just look at what they did when crafting the so-called "big, beautiful bill." With the exception of just a few conservatives, they demonstrated beyond any reasonable doubt that they think budget-busting recklessness is perfectly fine as long as Democrats aren't doing it! During the run-up to passage, there were a few objections, but Donald and his congressional allies told the conservatives where they could stick it in no uncertain terms.

In the WSJ piece lustylad posted, the author relates that he commissioned David Stockman, Reagan's budget director during his first term, to map out a way forward. However, Stockman must have realized the gravity of the challenge, since his own efforts in the early 1980s were effectively blockaded by the big-spenders in Congress.

Here's the transcript of a very interesting interview he did with Reason's Nick Gillespie almost 15 years ago:

https://reason.com/2011/03/21/the-tr...litics-over-e/

And the fiscal outlook has only gotten worse since then.

Much, much worse. |

Thanks, TC. I can always count on you and Tiny to offer intelligent comments. I didn't familiarize myself with everything packed into the Big Beautiful Bill (BBB), but my gut told me it would be politically foolish as well as bad economic policy to let the 2017 TCJA tax cuts expire, since that would have effectively resulted in a massive tax hike in 2026. For that reason, I supported the BBB.

As you probably know, the now-disbanded DOGE team lacked authority to implement spending cuts. It could only identify a tiny fraction of the WFA (Waste, Fraud and Abuse) that is rampant throughout the federal government. It's up to the individual executive agencies and Congress to rescind those spending items that were spotlighted by DOGE.

I'm pretty sure you, Tiny and I are probably the only posters in this forum who have a feel for the numbers behind our sorry fiscal outlook. Simple concepts such as Expenditures - Revenues = Deficit (or Surplus, once in a blue moon) seem beyond the comprehension of most of the posters here. Nuances, such as the vast difference between a deficit of 2-3% of GDP versus a spending gap of 8-10% of GDP, don't seem to register. Most posters lack even a rudimentary grasp of US economic history, such as the way we never paid off (or even paid down) our WW2 debt, but instead grew our way out of it.

That David Stockman interview is over 15 years old. And yes, the outlook has only gotten much, much worse since then. The pandemic blew up the deficit. Biden's spending spree ("never let a crisis go to waste") exacerbated the problem and kept the deficit ballooned. Has our experience chastened us in any way?

What is Professor Stefanie Kelton preaching now? The Biden Dems fully embraced her toxic and pernicious Modern Monetary Theory philosophy, and lo and behold - inflation soared! So my question is - what lessons, if any, did Professor Stefanie draw from that debacle? Was the result consistent with MMT or a repudiation of it? Being the custodian of the world's most widely accepted reserve & settlement currency doesn't mean we have a license to print & debase the US dollar forever to our heart's content without constraint. Anyone who thinks that won't end badly has no business teaching economics.

|

|

Quote

| 2 users liked this post |

12-04-2025, 12:45 AM

12-04-2025, 12:45 AM

|

#25

|

|

Lifetime Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 20,087

|

More WSJ "Clickbait"?

More WSJ "Clickbait"?

Here's another WSJ piece that is germane to the issues under discussion.

Is America Heading for a Debt Crisis? Look Abroad for Answers

All that stands between the U.S. and a debt-market freakout is the dollar. Having the world’s reserve currency isn’t the unbreakable shield many assume.

By James Mackintosh

Nov. 29, 2025 11:00 pm ET

Politics and debt don’t mix well. Americans would be wise to look across the Atlantic to see how tough things can get.

The U.K. government demonstrated the problem with its annual budget, where it is stuck in a trilemma, unable to please lenders and voters while also doing the right thing for the economy. Something had to give, so on Wednesday the government ignored its promises to go for growth, and focused on the bond market and its political base.

France has the same trilemma, only worse. Government debt is higher than in the U.K., the fiscal deficit is higher, and not only are tax rises politically impossible but taxes are already so high that raising them further might be self-defeating.

Spending cuts are even more difficult than in Britain - where welfare cuts have proved to be a political nonstarter - and securing a budget at all in a deeply riven French Parliament is a challenge. At least in London the bond panic during the super-short term of Prime Minister Liz Truss has shown the politicians that they have to pay attention to lenders.

Already some of the same issues are visible in the U.S. - along with a lack of political will to do anything to prevent the problem from festering. For now, all that stands between the U.S. and a debt-market freakout is the dollar. Having the world’s reserve currency, however, isn’t the unbreakable shield many assume.

Go back to the U.K. to see how dysfunctional politics limits action. The government floated the idea of an economically efficient income-tax rise in the run-up to the budget, and the bond market loved it. But politics made Chancellor of the Exchequer Rachel Reeves abandon the idea in favor of a series of smaller, delayed tax rises on pensions, corporate investment and driving that each slice a little off potential growth - but, she hopes, will get less attention from voters. The money raised goes into welfare spending forced on the government by its own members of Parliament, after it lost a fight earlier this year.

The parallel issue in the U.S. is tariffs: An inefficient tax on the purchase of certain foreign goods is possible (though the legality of the biggest tariffs is still to be determined), and even briefly popular. But U.S. politics is just as fragile as in the U.K., and when the bond market or voters objected, tariffs have been rolled back.

April’s so-called reciprocal tariffs were delayed and then slashed when the bond market panicked. They dropped from a peak effective rate of 28% to the current 18% calculated by the nonpartisan Budget Lab at Yale - far lower, although still the highest since 1934.

Likewise, rising voter concern about food prices has led to tariffs on imports of coffee, bananas and some beef being ditched. It was sensible to remove those, but it was especially bizarre to introduce charges on foodstuffs not even produced in the U.S. in the first place.

The U.S. doesn’t yet have the trilemma created by conflicting demands on tax, spending and borrowing, thanks to global demand for dollars funneling money into Treasurys. But there are worrying signs, and the fiscal situation suggests a growing chance of trouble ahead - despite faster economic growth than elsewhere.

Warnings of bond pressure have shown up in extreme situations. Most recent was the April revolt, where 10-year Treasury yields jumped and concern grew about a self-fulfilling liquidation of borrowing, akin to the U.K.’s Truss moment, before President Trump pulled back. In 2020, lockdowns showed how bad such a selling spiral can be, and the Federal Reserve was forced to buy more than $1 trillion of bonds to stabilize the market.

The fiscal situation in the U.S. is far worse than what Reeves has to deal with in Britain. The International Monetary Fund estimates that total U.K. government debt will hit 95% of gross domestic product this year, with a deficit of 4.3%. U.S. debt is expected to be a smidgen below 100%, with a deficit on course to be one of the biggest in the developed world at more than 7%.

What saves American finance is the dollar’s status as the must-have global asset and trading currency. Both roles face challenges, though, and the more the U.S. exploits foreigners, the higher the risk they look elsewhere.

There are four overlapping threats to the dollar: supply, China, reserve safety and the pushing away of allies.

Supply is the big one, as the U.S. runs near-record peacetime deficits on top of a bulging current-account deficit. America has to attract a constant flow of foreign capital to finance government and imports, an unstable position.

China has shifted a little more trade into yuan, although the dollar remains by far the dominant currency for international payments. China, Russia and others including Turkey have been replacing some of their reserves with gold in the midst of rising concern about dollar-based reserves being frozen or confiscated by Washington. And while allied governments haven’t obviously cut their dollar exposure, they were spooked by Trump’s tariffs and talk of unilateral fees on reserves held in Treasurys.

None of these has, so far, dealt significant damage to the dollar’s reserve status. But they all hurt. The risk is that the market senses a shift coming and pushes up Treasury yields in anticipation of foreign buyers drifting away.

On the plus side, it is economically easy for the U.S. to head off the problem. It raises the lowest tax as a share of GDP of any Group of Seven country, at just 30%, so higher taxes are likely to damage growth less than elsewhere. Government spending, also the lowest in the G-7, is harder to cut, as the failure of Elon Musk’s Department of Government Efficiency demonstrated.

If the problem sounds familiar, it should be. Former Luxembourg Prime Minister and European Commission President Jean-Claude Juncker once said: “We all know what to do, we just don’t know how to get re-elected after we’ve done it.”

It isn’t clear that today’s politicians do, in fact, know what to do. But whether they know or not, getting re-elected while staying within the strictures of the bond market is going to be tough. America has the dollar to lean on—but probably not forever.

https://www.wsj.com/finance/investin...ssons-38bc52e3

|

|

Quote

| 3 users liked this post |

12-04-2025, 11:13 AM

12-04-2025, 11:13 AM

|

#26

|

|

Lifetime Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 20,087

|

Keynes 101

Keynes 101

Quote:

Originally Posted by txdot-guy

Democrats usually believe that the Government should spend during recessions and spend more during bull markets.

|

Quote:

Originally Posted by Tiny

Fixed that for you (red text)

|

+1

Lol! So true! Now let me offer another FTFY:

Quote:

Originally Posted by txdot-guy

Keynesians believe that the Government should spend during recessions and stop "priming the pump" during bull markets.

|

"The boom, not the slump, is the right time for austerity." -JMK

Austerity can take the form of spending cuts or tax increases, or some combination thereof. Austerity does NOT mean leaving spending permanently at the crisis levels to which it is boosted during a slump.

Quote:

Originally Posted by txdot-guy

There has been government deficit spending since 1969 except during the end of Clinton’s Presidency and the beginning of Bush’s presidency.

|

Yep. Exactly right. Now let's take a look at the frequency of economic recessions in the US:

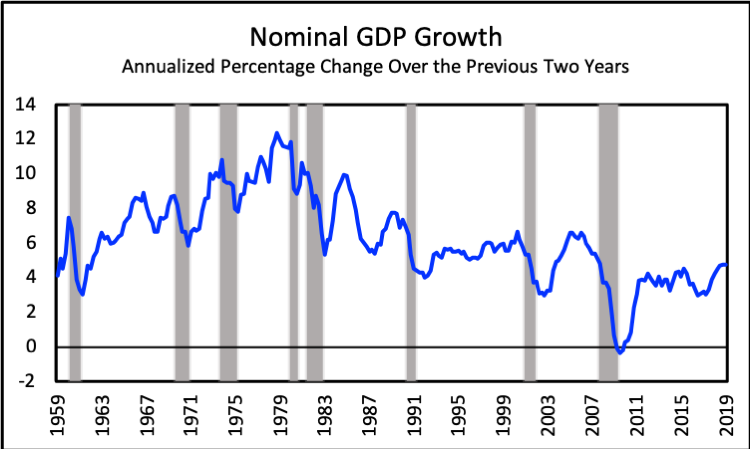

The shaded bars in the graph above represent periods of economic contraction, i.e. what Keynes calls the "slump". As you can see, the economy is expanding roughly 85-90% of the time. Per Keynes, we are only justified in running fiscal deficits during the other 10%-15% of the time. So the politicians have everything upside down. They've been running deficits 90% of the time, and surpluses only 10% of the time. Keynes never ever ever taught that we should run deficits in good years AND bad years. That's a perversion of everything he preached.

|

|

Quote

| 3 users liked this post |

12-04-2025, 12:46 PM

12-04-2025, 12:46 PM

|

#27

|

|

Lifetime Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 20,087

|

Quote:

Originally Posted by txdot-guy

Tax cuts can provide the economy with growth that can offset the tax cuts but that rarely happens.

|

^^^ You should avoid sweeping generalizations like this. All tax cuts are NOT created equal. Some are designed to stimulate consumer spending. Others may target capital investment. Still others may encourage employers to hire more workers.

Private sector growth always generates higher government tax revenues, all other variables held constant. The question you raise is - will a specific cut in tax rates result in higher or lower (net) revenues? Usually the answer is lower. But there are exceptions. The most obvious one, which Tiny and TC and I have pointed out many times in this forum, is the tax on (long-term) capital gains. Experience shows that each time the capital gains tax has been lowered, the US Treasury raked in a revenue bonanza far in excess of what it forecast.

For other types of tax cuts, we need to apply dynamic scoring to forecast the revenue impact accurately. The CBO usually applies a static scoring model, but Republicans have pushed to change this. A dynamic model doesn't mean a particular tax reduction will "pay for itself", but it can often reduce the forecast net revenue loss by up to 1/3.

I'll stop now, because I'm starting to generalize too. As I said, all tax cuts are different. Even when you analyze similar tax cuts, the growth/revenue impacts can differ considerably depending on the economic circumstances when each is enacted.

Quote:

Originally Posted by txdot-guy

Tax cuts are only effective for broad economic growth when the economy needs the extra stimulus.

|

Now you sound like a Keynesian. You're saying we don't need tax cuts if the economy is already robust and running at full employment. In that case, they may result in excessive aggregate demand, driving up inflation rather than growth.

The same reasoning applies to over-spending. In 2021, the US economy grew by a whopping 6% in real terms. This strong growth was partly a rebound from the pandemic shut-downs. But the Democrats also injected way too much money into (over-) stimulating the economy with the $1.9 trillion American Rescue Plan passed in March 2021. Much of it was disbursed in the form of "helicopter money". This was far more than the economy needed or could absorb without a rapid burst of inflation, which soared to an annual rate of 9.0% over the ensuing 15 months.

|

|

Quote

| 3 users liked this post |

12-08-2025, 02:55 PM

12-08-2025, 02:55 PM

|

#28

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,410

|

The Swamp is the Undisputed Heavyweight Champion of the World!

The Swamp is the Undisputed Heavyweight Champion of the World!

Quote:

Originally Posted by lustylad

As you probably know, the now-disbanded DOGE team lacked authority to implement spending cuts.

|

Yup. And that's pretty much the same problem Stockman's team ran into 44 years ago -- little or no buy-in from most congressional members, who had their own agendas and just weren't feeling the love. Like Stockman's team, DOGE didn't have the legal or constitutional authority to do much besides talk.

Quote:

Originally Posted by lustylad

What is Professor Stefanie Kelton preaching now? The Biden Dems fully embraced her toxic and pernicious Modern Monetary Theory philosophy, and lo and behold - inflation soared! So my question is - what lessons, if any, did Professor Stefanie draw from that debacle? Was the result consistent with MMT or a repudiation of it? Being the custodian of the world's most widely accepted reserve & settlement currency doesn't mean we have a license to print & debase the US dollar forever to our heart's content without constraint. Anyone who thinks that won't end badly has no business teaching economics.

|

Professor Stephanie seems to have gone radio silent! The thing that always struck me as borderline comical about the MMT case is that the doctrine's supposed "remedy" in case of an inflation breakout is to quickly implement a tax increase. (Well, sure. A tax increase -- particularly if you raise taxes on those with relatively high marginal propensity to consume --might quickly quell demand-pull inflation. But doesn't that render the whole MMT idea self-defeating?)

Quote:

Originally Posted by lustylad

I didn't familiarize myself with everything packed into the Big Beautiful Bill (BBB), but my gut told me it would be politically foolish as well as bad economic policy to let the 2017 TCJA tax cuts expire, since that would have effectively resulted in a massive tax hike in 2026. For that reason, I supported the BBB.

|

I didn't familiarize myself with everything packed into it, either, but certainly agree that rescinding the 2017 tax cuts would have foolish both from a strictly political and economic policy point of view, especially inasmuch as it would have amounted to a large tax increase on the middle class; a political non-starter if there ever was one.

I sure wish that more members of the House and Senate had pushed harder for fiscal restraint, though.

Ron Johnson, the conservative Senator from Wisconsin, asked why we couldn't just go through every line and return to the aggregate spending level of 2019, adjusted for inflation and for the small growth in population over the period. (That's a good question!) As Tiny noted, a couple of others, such as Rand Paul and Chip Roy, were also making similar points. But they got lost in the crowd.

Perhaps Ramaswamy was smart to see the handwriting on the wall very early and get out of Dodge (or DOGE) before there was any chance his fingerprints would be found anywhere near the scene.

When it began to be clear that DOGE-related efforts would crash into the obstruction and obfuscation factory that answers to the name of the US Congress, the whole adventure soon looked more and more like a busted flush.

Once again, just as in the early 1980s, we saw the triumph of politics over economics.

|

|

Quote

| 4 users liked this post |

12-12-2025, 08:11 PM

12-12-2025, 08:11 PM

|

#29

|

|

Enano Poderoso

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,984

|

Quote:

Originally Posted by Texas Contrarian

They certainly could give it a try! But just look at what they did when crafting the so-called "big, beautiful bill." With the exception of just a few conservatives, they demonstrated beyond any reasonable doubt that they think budget-busting recklessness is perfectly fine as long as Democrats aren't doing it! During the run-up to passage, there were a few objections, but Donald and his congressional allies told the conservatives where they could stick it in no uncertain terms.

In the WSJ piece lustylad posted, the author relates that he commissioned David Stockman, Reagan's budget director during his first term, to map out a way forward. However, Stockman must have realized the gravity of the challenge, since his own efforts in the early 1980s were effectively blockaded by the big-spenders in Congress.

Here's the transcript of a very interesting interview he did with Reason's Nick Gillespie almost 15 years ago:

https://reason.com/2011/03/21/the-tr...litics-over-e/

And the fiscal outlook has only gotten worse since then.

Much, much worse. |

Very interesting TC. I agree more than I disagree with what Stockman says in the interview, as you'd expect. After all, I got my D.Div. degree from the DeVry Institute of Divinity and Stockman studied at Harvard's School of Divinity.

I'm not sure about his criticism of Hank Paulson's troubled-asset support programs or his enthusiasm for the gold standard. I agreed with Stockman at the time, that the government shouldn't be bailing out financial institutions and large companies post 2008. But looking back I think I was wrong. The government probably made a little money overall on the bailouts. And when markets are irrational in a way that will destroy jobs and throw the country into a deeper recession, maybe government support makes sense, especially if accomplished in a way that won't cause the taxpayer or the national debt to take a big hit in the long run.

As to the gold standard, that's way above my pay grade. Intuitively I don't think it was sustainable.

Btw, Any thoughts you or LustyLad, our two top economists, would have on bailouts, the gold standard or FDIC insurance would be insightful to the rest of us.

Getting back to LustyLad's topic, Stockman basically threw in the towel and decided we can't do jack to reduce government spending. So taxes have to be high to avoid burdening future generations with an unsustainable debt. And he may be right. But damnit, I wish he weren't. And I'm not sure. The idea of starving the beast appeals to me, although I'm not sure it's doable with the bozos we keep electing. They don't like to cut, or for that matter even keep spending levels where they are.

I liked the following from the interview, about cold war defense spending:

Someone said that in the 1980s we were in a race with the Soviet Union to see who could reach bankruptcy first. They won by a hair.

I also liked his description of social security and Medicare, and hope adav8s28 will read that part. It might change his mind about whether they're Ponzi schemes.

|

|

Quote

| 1 user liked this post |

12-13-2025, 07:51 AM

12-13-2025, 07:51 AM

|

#30

|

|

Valued Poster

Join Date: Apr 8, 2013

Location: houston, tx

Posts: 10,698

|

Why DOGE Was Silly From the Get-Go

Why DOGE Was Silly From the Get-Go

the problem with DOGE is...DOGE.

When companies are losing their shirt, they have 2 pieces to fix: the cost side and/or the revenue side. Fixing the revenue side can be hard. Fixing the cost side is easy: lay off workers. So if the CEO doesn't want to be the bad guy, he'll bring in a contractor like Musk to figure out who to cut, and how many jobs.

the implied promise of DOGE is that it would fix our chronic budget woes. just a small problem: fire the entire federal workforce and you haven't made even a tiny dent in the red ink. somehow, the richest, smartest guy in the world didn't get the memo..

all that created fake drama, cruelty and stress for our federal workforce, in addition to horrifically harmful cuts to science, medicine, and technology, added up to a grand total of..wait for it..a grand total off our federal deficit of..0$ and 0 cents. Yes, you read that right.

simple reason: the federal workfoce isn't our cost problem; entitlements, necessary spending-e.g., interest on the debt-and discretionary spending-e.g., the military-is.

so, if you want to turn the deficit into a surplus and start paying off the debt, you-

a. cut spending;

b. raise taxes; or

c. both.

it's 4th grade math. really.

personally, i say do both. return tax policy to Clinton-era levels, the last admin to run a balanced budget btw, and cut spending. Medicare is bloated and does not serve the proper party; it caters to providers, not to patients. Let's fix that for starters, and kill the Medicare Advantage plans, which are corporate welfare at their worst, and negotiate the fuck outta Big Pharma. Then raise the social security retirement age, remove the income cap and payout caps on FICA taxes, tax realized capital gains (and losses) at ordinary income rates, tax carbon to save the planet, and maybe even keep Trump's hated tariffs, especially on adversaries, unless there is no domestic market to protect, and now, who knew, you turn the deficit into a surplus and start paying down the debt to 0, while MAGA..

i'm all for a trade surplus too. let's get guest workers in here so we can actually compete with China on manufactured goods which, hilariously, is still eating our lunch on the trade deficit (!)-[wait i thought Trump was going to fix all that, and only he could do it; wtf happened there??]-and if you do all that, you MAGA, like right after WWII when our trade partners were blitzkrieged and we were the only one left standing.

it's all so simple. why in the actual fuck did someone as smart as Musk think DOGE would have any impact on the pile of federal red ink? it's like he was trying to solve a deer overpopulation problem by buying a bunch of fishing poles. like, "Hello? Hello? Anybody home? Think, McFly, think!"

we are on the road to perdition, and Trump hasn't done 1 effective thing to stop it. but he doesn't care; he'll be dead and gone when it comes time to pay the piper, and gives absolutely zero fucks about future generations of Americans, who will be left to play a 2, 5 unsuited before the flop.

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|