Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

650 |

| MoneyManMatt |

490 |

| Jon Bon |

408 |

| Still Looking |

399 |

| samcruz |

399 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| George Spelvin |

337 |

| Starscream66 |

314 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| You&Me |

281 |

| sharkman29 |

270 |

|

Top Posters

Top Posters |

| DallasRain | 71583 | | biomed1 | 70906 | | Yssup Rider | 63913 | | gman44 | 55938 | | LexusLover | 51038 | | offshoredrilling | 50415 | | WTF | 48272 | | bambino | 47221 | | pyramider | 46457 | | The_Waco_Kid | 41894 | | Dr-epg | 38718 | | CryptKicker | 37452 | | Mokoa | 36517 | | Chung Tran | 36100 | | Still Looking | 35944 |

|

|

01-29-2026, 01:41 PM

01-29-2026, 01:41 PM

|

#346

|

|

Premium Access

Join Date: Jan 31, 2010

Location: TX

Posts: 1,720

|

US trade deficit widens by the most in nearly 34 years in November

https://finance.yahoo.com/news/us-tr...144236696.html

https://www.newsmax.com/finance/stre...29/id/1244049/

The U.S. trade deficit widened by the most in nearly 34 years in November amid a surge in capital goods imports, likely driven by an artificial intelligence investment boom, which could prompt economists to trim their economic growth estimates for the fourth quarter.

Quote:

Imports jumped 5.0% to $348.9 billion. Goods imports advanced 6.6% to $272.5 billion, with capital goods soaring $7.4 billion to a record high. They were boosted by strong gains in imports of computers and semiconductors. But imports of computer accessories decreased by $3.0 billion.

Imports of other goods were also the highest on record. Consumer goods imports increased by $9.2 billion, lifted by pharmaceutical preparations. There have been large swings in imports of pharmaceutical preparations, likely related to U.S. tariffs. Imports of industrial supplies fell by $2.4 billion.

Exports tumbled 3.6% to $292.1 billion in November. Goods exports plunged 5.6% to $185.6 billion. They were pulled down by a decline of $6.1 billion in exports of industrial supplies and materials, reflecting decreases in non-monetary gold, other precious metals as well as crude oil, which dropped by $1.4 billion.

|

Weren't tariffs supposed to change this?

|

|

Quote

| 1 user liked this post |

01-29-2026, 02:19 PM

01-29-2026, 02:19 PM

|

#347

|

|

Premium Access

Join Date: Jan 31, 2010

Location: TX

Posts: 1,720

|

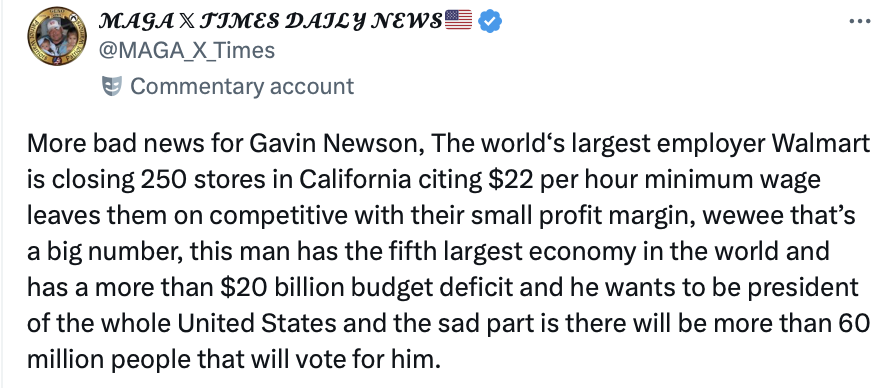

Dang......

https://truthsocial.com/@realDonaldT...76147900633194

https://truthsocial.com/@realDonaldT...76147900633194

Ohhhh...wait...just more misinformation from Trump...

“This isn’t accurate information,” a Walmart spokesperson said. “In fact, we actually just recently opened a new store in California.”

|

|

Quote

| 1 user liked this post |

01-29-2026, 03:46 PM

01-29-2026, 03:46 PM

|

#348

|

|

Premium Access

Join Date: Jan 31, 2010

Location: TX

Posts: 1,720

|

so much for 50% cheaper energy

Quote:

According to the NEADA analysis, electricity costs are expected to rise $12.2%, or $133 this winter, while gas prices are projected to rise 8.4% or $54. Heating oil costs are expected to remain flat, while propane should be down 1.4%, or $18 this winter.

NEADA notes that more than 210 electric and natural gas utilities have either raised rates or proposed to do so within the next two years, which amounts to roughly $85.5 billion - and continues a trend seen in recent years of average monthly residential electricity bills rising faster than average inflation.

|

https://oilprice.com/Energy/Energy-G...g-Started.html

|

|

Quote

| 1 user liked this post |

01-29-2026, 07:39 PM

01-29-2026, 07:39 PM

|

#349

|

|

Lifetime Premium Access

Join Date: Apr 25, 2009

Location: sa tx usa

Posts: 16,694

|

Quote:

Originally Posted by RX792P

|

Quote:

Originally Posted by RX792P

|

Quote:

Originally Posted by RX792P

|

Where is the didgeridoo playing dude who always says WINNING?

|

|

Quote

| 1 user liked this post |

01-30-2026, 07:53 AM

01-30-2026, 07:53 AM

|

#350

|

|

Premium Access

Join Date: Jan 31, 2010

Location: TX

Posts: 1,720

|

Trump

Quote:

"I don't want to drive housing prices down. I want to drive housing prices up for people that own their homes. And they can be assured that's what's going to happen.

"

"Existing housing, people that own their homes, we're going to keep them wealthy," Trump said. "We're going to keep those prices up. We're not going to destroy the value of their homes so that somebody who didn't work very hard can buy a home.

"We're going to make it easier to buy," the president added. "We're going to get interest rates down. But I want to protect the people who, for the first time in their lives, feel good about themselves. They feel like, you know, that they're wealthy people."

|

|

|

Quote

| 1 user liked this post |

Yesterday, 09:45 AM

Yesterday, 09:45 AM

|

#351

|

|

Premium Access

Join Date: Jan 31, 2010

Location: TX

Posts: 1,720

|

Quote:

Originally Posted by CPT Savajo

|

Maybe you're happy about this? Don't know.

Silver’s plunge on Friday was the metal’s worst daily drop since 1980 and was described by one strategist as “every man and his dog rushing for the exit.”

|

|

Quote

|

Yesterday, 09:53 AM

Yesterday, 09:53 AM

|

#352

|

|

Valued Poster

Join Date: Feb 9, 2011

Location: Earth

Posts: 955

|

First Bank Failure of 2026 Metropolitan Capital Bank & Trust of Chicago

First Bank Failure of 2026 Metropolitan Capital Bank & Trust of Chicago

The first bank failure of 2026 strategically reported over the weekend while financial markets were closed. Many more bank failures are quite possibly on the way. Metropolitan Capital Bank & Trust is the first domino to fall.

https://cryptoslate.com/first-us-ban...d-losses-loom/

"Late on Friday, Illinois regulators shut down Metropolitan Capital Bank and Trust, a little-known institution with just $261 million in assets, handing control to the FDIC in what was officially a routine resolution.

But it landed in the middle of a much louder market shock.

On the same day the bank failed, gold and silver saw one of their sharpest one-day plunges in decades, and Bitcoin sold off sharply amid the broader rush out of risk. 24 hours later, and the markets that are open over the weekend are almost in free fall."

In the above paragraph they speak of gold and silver as if it's risk when it's the lifeboat. The dollar (fiat currency) is the Titanic that Central Banks are dumping for the lifeboat.

|

|

Quote

|

Yesterday, 09:59 AM

Yesterday, 09:59 AM

|

#353

|

|

Valued Poster

Join Date: Feb 9, 2011

Location: Earth

Posts: 955

|

Quote:

Originally Posted by RX792P

Maybe you're happy about this? Don't know.

Silver’s plunge on Friday was the metal’s worst daily drop since 1980 and was described by one strategist as “every man and his dog rushing for the exit.”

|

Friday's bloodbath represents an opportunity for the strong hands. The shorts are desperate as the vaults are being drained. Dumping paper contracts to bring down the price of physical metal is absurd and what you're witnessing is a distortion while China and India turn on the vacuum cleaners to suck up every available ounce out of the West. The fundamentals have not changed. China cutting off 60%-70% of the worlds refined silver supply starting 1 January 2026 has not changed. Governments, industrial titans, and investors are scrambling for supply in a tight physical market. The question is, will the Comex or LBMA declare Force Majeure because they cannot deliver metal and have to settle contracts in cash? Such declaration will be an implosion of epic proportions.

|

|

Quote

|

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|