Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

650 |

| MoneyManMatt |

490 |

| Jon Bon |

408 |

| Still Looking |

399 |

| samcruz |

399 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| George Spelvin |

324 |

| DFW_Ladies_Man |

313 |

| Starscream66 |

306 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| You&Me |

281 |

| sharkman29 |

263 |

|

Top Posters

Top Posters |

| DallasRain | 71451 | | biomed1 | 69036 | | Yssup Rider | 62981 | | gman44 | 55308 | | LexusLover | 51038 | | offshoredrilling | 49727 | | WTF | 48272 | | pyramider | 46442 | | bambino | 45243 | | The_Waco_Kid | 40758 | | CryptKicker | 37426 | | Mokoa | 36516 | | Chung Tran | 36100 | | Dr-epg | 35975 | | Still Looking | 35944 |

|

|

08-02-2023, 02:14 PM

08-02-2023, 02:14 PM

|

#1

|

|

Valued Poster

Join Date: Sep 4, 2022

Location: Pittsburgh

Posts: 719

|

Trumps tax cuts for the middle class, Yeah RIght!

Trumps tax cuts for the middle class, Yeah RIght!

The middle class needs a tax cut. Trump didn't give it to them like he said he did.

https://www.brookings.edu/articles/t...ve-it-to-them/

|

|

Quote

| 1 user liked this post |

08-02-2023, 02:57 PM

08-02-2023, 02:57 PM

|

#2

|

|

Valued Poster

Join Date: Nov 11, 2012

Location: Pittsburgh

Posts: 16,225

|

LOL - Why would you post something so false and so easily disproven?

I know it won't help with your class warfare but you may want to try some actual facts - you know, like ACTUAL IRS DATA, not some false 5 year old opinion piece.

Here is the ACTUAL TRUTH

IRS data proves Trump tax cuts benefited middle, working-class Americans most

Income data published by the IRS clearly show that on average all income brackets benefited substantially from the Republicans’ tax reform law, with the biggest beneficiaries being working and middle-income filers, not the top 1 percent, as so many Democrats have argued.

A careful analysis of the IRS tax data, one that includes the effects of tax credits and other reforms to the tax code, shows that filers with an adjusted gross income (AGI) of $15,000 to $50,000 enjoyed an average tax cut of 16 percent to 26 percent in 2018, the first year Republicans’ Tax Cuts and Jobs Act went into effect and the most recent year for which data is available.

Filers who earned $50,000 to $100,000 received a tax break of about 15 percent to 17 percent, and those earning $100,000 to $500,000 in adjusted gross income saw their personal income taxes cut by around 11 percent to 13 percent.

By comparison, no income group with an AGI of at least $500,000 received an average tax cut exceeding 9 percent, and the average tax cut for brackets starting at $1 million was less than 6 percent. (For more detailed data, see my table published here.)

That means most middle-income and working-class earners enjoyed a tax cut that was at least double the size of tax cuts received by households earning $1 million or more.

What’s more, IRS data shows earners in higher income brackets contributed a bigger slice of the total income tax revenue pie following the passage of the tax reform law than they had in the previous year.

In fact, every income bracket with filers earning $200,000 or more increased its tax burden in 2018 compared to 2017, and every income bracket with a top limit lower than $200,000 paid a smaller proportion of the total personal tax revenue collected.

That means that Republicans’ tax reform law resulted in the tax code becoming slightly more progressive — the exact opposite of what Democrats have claimed over the past four years.

The IRS data further shows that the tax reform law — which included a variety of business tax cuts, including a large reduction in the corporate income tax rate — spurred economic mobility.

Every income bracket with a top level lower than $25,000 experienced a reduction in its number of filers, and every income bracket above $25,000 increased in size, with the biggest gains occurring in the brackets with a floor of at least $100,000.

The fact is, Republicans’ 2017 tax reform law did exactly what was promised: It lowered taxes for all income groups, provided the greatest benefits for middle-income households, and spurred economic growth that helped reduce poverty and improve prosperity.

|

|

Quote

| 2 users liked this post |

08-02-2023, 03:05 PM

08-02-2023, 03:05 PM

|

#3

|

|

Premium Access

Join Date: Sep 2, 2022

Location: Pittsburgh PA

Posts: 6,081

|

Your cut & paste with no link doesn't disprove anything. It's been well established that 85% of the total benefit went to the top 1% of earners.

Why are trump people so happy that he made his rich criminal friends even richer, while throwing a few crumbs to everyone else?

|

|

Quote

| 2 users liked this post |

08-02-2023, 03:29 PM

08-02-2023, 03:29 PM

|

#4

|

|

Valued Poster

Join Date: Nov 11, 2012

Location: Pittsburgh

Posts: 16,225

|

Quote:

Originally Posted by tommy156

Your cut & paste with no link doesn't disprove anything. It's been well established that 85% of the total benefit went to the top 1% of earners.

Why are trump people so happy that he made his rich criminal friends even richer, while throwing a few crumbs to everyone else?

|

Why do you continue to post blatantly false information that is so easily disproven?

The only thing well established is the ACTUAL IRS DATA I posted showing the biggest cuts went to the middle class

Since you must have missed it the first time:

AGI $15,000 to $50,000 - an average tax cut of 16 percent to 26 percent

$50,000 to $100,000 - a tax break of about 15 percent to 17 percent

$100,000 to $500,000 - a cut of around 11 percent to 13 percent

over $500,000 an average tax cut of 9 percent

over $1 million an average cut less than 6 percent.

|

|

Quote

| 2 users liked this post |

08-02-2023, 04:29 PM

08-02-2023, 04:29 PM

|

#5

|

|

Valued Poster

Join Date: Sep 4, 2022

Location: Pittsburgh

Posts: 719

|

You talk about people posting false information. I remember you posting 20 times a day of how the election was stolen off of Bone Spurs. You remember that correct? You posted garage information of how when someone voted for Trump Biden got votes on those crooked machines. You remember that correct?

I have a question, HOW DID THAT WORK OUT? I tell you how, Fox News paid 3/4 of a Billion dollars for not telling the truth.

10 times daily you said Trump was going to take over complete with all information to prove he was.

Again HOW DID THAT WORK OUT?

|

|

Quote

| 2 users liked this post |

08-02-2023, 05:19 PM

08-02-2023, 05:19 PM

|

#6

|

|

Premium Access

Join Date: Mar 16, 2016

Location: Steel City

Posts: 9,658

|

Some remedial math lessons are clearly called for. Regardless, the middle class in the US is undertaxed and needs to start contributing.

|

|

Quote

| 2 users liked this post |

08-02-2023, 05:30 PM

08-02-2023, 05:30 PM

|

#7

|

|

AKA ULTRA MAGA Trump Gurl

Join Date: Jan 8, 2010

Location: The MAGA Zone

Posts: 40,758

|

Quote:

Originally Posted by tommy156

Your cut & paste with no link doesn't disprove anything. It's been well established that 85% of the total benefit went to the top 1% of earners.

Why are trump people so happy that he made his rich criminal friends even richer, while throwing a few crumbs to everyone else?

|

here's the link

https://thehill.com/opinion/finance/...mericans-most/

IRS data proves Trump tax cuts benefited middle, working-class Americans most

interestingly, both the Brookings Institute and The Hill are rated "Center" in terms of bias.

the Brookings Institute's analysis is flawed. the article is from 2018 less than a full year after the 2017 tax cuts. it's not based entirely on actual data, because there wasn't any yet. The Hill on the other hand waited almost 3 more years to nearly 2023 and used actual IRS data to make their determination.

speaking of links .. you can provide one to support your claim above, yes?

|

|

Quote

| 3 users liked this post |

08-02-2023, 05:48 PM

08-02-2023, 05:48 PM

|

#8

|

|

AKA ULTRA MAGA Trump Gurl

Join Date: Jan 8, 2010

Location: The MAGA Zone

Posts: 40,758

|

Quote:

Originally Posted by Jacuzzme

Some remedial math lessons are clearly called for. Regardless, the middle class in the US is undertaxed and needs to start contributing.

|

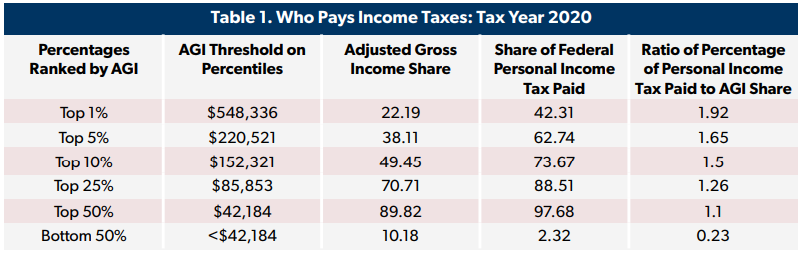

they do contribute of course but a case could be made they should contribute more. as everyone knows .. the liberal manta of "the rich need to pay their fair share!!" is nonsense since it's known fact that the top 10 percent (including TWK) pay the largest slice by far of tax revenue.

the US tax rates are progressive .. even if the progressives claim otherwise and want to tax the top earners even more to make up for the welfare bums who don't pay any taxes while also receiving a slew of tax credits and subsidies .. paid for by the top earners.

|

|

Quote

| 1 user liked this post |

08-02-2023, 06:55 PM

08-02-2023, 06:55 PM

|

#9

|

|

Premium Access

Join Date: Mar 16, 2016

Location: Steel City

Posts: 9,658

|

Only fair way is that everyone pays x% of their income.

|

|

Quote

| 2 users liked this post |

08-02-2023, 07:31 PM

08-02-2023, 07:31 PM

|

#10

|

|

AKA ULTRA MAGA Trump Gurl

Join Date: Jan 8, 2010

Location: The MAGA Zone

Posts: 40,758

|

Quote:

Originally Posted by Jacuzzme

Only fair way is that everyone pays x% of their income.

|

agreed but try selling that to the Democrats and their welfare class where 40 percent of adults in the US don't pay taxes ..

In total, about 59.9 percent of U.S. households paid income tax in 2022. The remaining 40.1 percent of households paid no individual income tax.

40 percent.

then there is this ...

What percentage of the US population pays the most taxes?

The average federal income tax rate was 13.6% in 2020, according to a January analysis from the Tax Foundation. But the top 1% of earners paid an average rate of about 26%, while the bottom half of taxpayers had an overall rate of 3.1%, the analysis found.Apr 17, 2023

|

|

Quote

| 3 users liked this post |

08-02-2023, 08:57 PM

08-02-2023, 08:57 PM

|

#11

|

|

Premium Access

Join Date: Jan 21, 2010

Location: Erie

Posts: 4,447

|

Quote:

Originally Posted by The_Waco_Kid

here's the link

https://thehill.com/opinion/finance/...mericans-most/

IRS data proves Trump tax cuts benefited middle, working-class Americans most

interestingly, both the Brookings Institute and The Hill are rated "Center" in terms of bias.

the Brookings Institute's analysis is flawed. the article is from 2018 less than a full year after the 2017 tax cuts. it's not based entirely on actual data, because there wasn't any yet. The Hill on the other hand waited almost 3 more years to nearly 2023 and used actual IRS data to make their determination.

speaking of links .. you can provide one to support your claim above, yes? |

lol you could provide every link possible to some posters and they still will say it doesnt mean anything

|

|

Quote

| 3 users liked this post |

08-02-2023, 11:04 PM

08-02-2023, 11:04 PM

|

#12

|

|

Valued Poster

Join Date: Nov 11, 2012

Location: Pittsburgh

Posts: 16,225

|

Quote:

Originally Posted by Jacuzzme

Some remedial math lessons are clearly called for. Regardless, the middle class in the US is undertaxed and needs to start contributing.

|

Clearly they are

And you are correct - the middle and lower class are undertaxed relative to everyone else. When the top 10% of the population pay 74% of all the income taxes, that is a problem. It is even more of a problem when the bottom 50% of the population pay 2% of all the income taxes

It is simply not sustainable to have half the country being free loaders

As you note, the solution is a flat tax - get rid of every deduction, every single bit of the tax code and have every person in the country pay the same x% of their income.

|

|

Quote

| 2 users liked this post |

08-02-2023, 11:09 PM

08-02-2023, 11:09 PM

|

#13

|

|

Valued Poster

Join Date: Nov 11, 2012

Location: Pittsburgh

Posts: 16,225

|

Quote:

Originally Posted by The_Waco_Kid

here's the link

https://thehill.com/opinion/finance/...mericans-most/

IRS data proves Trump tax cuts benefited middle, working-class Americans most

interestingly, both the Brookings Institute and The Hill are rated "Center" in terms of bias.

the Brookings Institute's analysis is flawed. the article is from 2018 less than a full year after the 2017 tax cuts. it's not based entirely on actual data, because there wasn't any yet. The Hill on the other hand waited almost 3 more years to nearly 2023 and used actual IRS data to make their determination.

speaking of links .. you can provide one to support your claim above, yes? |

Yeah - very easy for anyone to google that. I made a decision a while ago to quit spoon feeding people with every single link and let them find it themselves for exactly the reason Chizzy noted. I used to provide every single link and some of the leftists still never believed it or tried to dismiss it so . . .

And as you noted, he provided no link to the information he posted (I would guess it is tough to provide a link to false information)

|

|

Quote

| 3 users liked this post |

08-03-2023, 05:14 AM

08-03-2023, 05:14 AM

|

#14

|

|

Premium Access

Join Date: Mar 16, 2016

Location: Steel City

Posts: 9,658

|

Another ~big~ part of the Jacuzzme tax plan is no payroll deduction. Each taxpayer (citizen) is responsible for saving for their own payment, writing and sending in a quarterly check. People would be much more conscious of wasteful government spending if they actually had the money and were forced to give it up. We could also boycott the federal government, which would be awesome.

|

|

Quote

| 1 user liked this post |

08-03-2023, 12:13 PM

08-03-2023, 12:13 PM

|

#15

|

|

Valued Poster

Join Date: Sep 4, 2022

Location: Pittsburgh

Posts: 719

|

Quote:

Originally Posted by Jacuzzme

Another ~big~ part of the Jacuzzme tax plan is no payroll deduction. Each taxpayer (citizen) is responsible for saving for their own payment, writing and sending in a quarterly check. People would be much more conscious of wasteful government spending if they actually had the money and were forced to give it up. We could also boycott the federal government, which would be awesome.

|

Yeah a real genus.. No payroll deduction. Wage tax didn't get paid and that was only 1% till they made it come out of everyone's pay. Yeah no problem with federal tax being paid. LOL Thursday afternoon humor.

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|